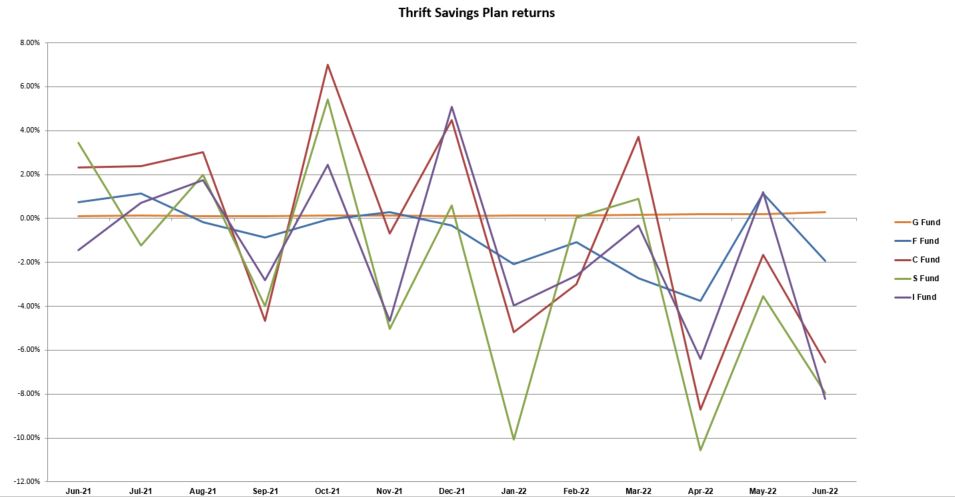

The federal government’s 401(k)-style retirement savings plans experienced a slight uptick in May before continuing its long-running decline last month.

All other bond funds and stocks in the Thrift Savings Plan were below their May performance and negative, except for the government securities investment G fund, which showed improved returns over the past month.

The G fund was the only one to achieve positive year-over-year gains, according to the most recent results reported by the TSP today, finishing June at 0.29 percent, up from 0.21 percent in May and 0.12 percent in June 2021.

The International Stock Index I fund experienced the most significant monthly decline, dropping from 1.19 percent in May to -8.21 percent in June. Even though the I fund decreased in June 2021, it did so by a smaller margin than the previous yearâ€â€6.77 percentage points.

The common stock index C fund experienced the second-largest monthly decline, ending the month of June at -6.55 percent vs.-1.65 percent in May. The returns for the fixed income index F fund were 1.94 percent last month compared to 1.13 percent in May, while the small-cap stock index S fund had returns of -7.95 percent and -3.53 percent, respectively, in June.

The TSP was lower overall than it was a year ago, and this year’s high inflation has impacted several economic sectors, particularly the energy and food industries. According to the Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers rose 8.6 percent between May 2021 and May 2022. This is the highest 12-month increase since the period ending in December 1981.

The situation is not getting any better.

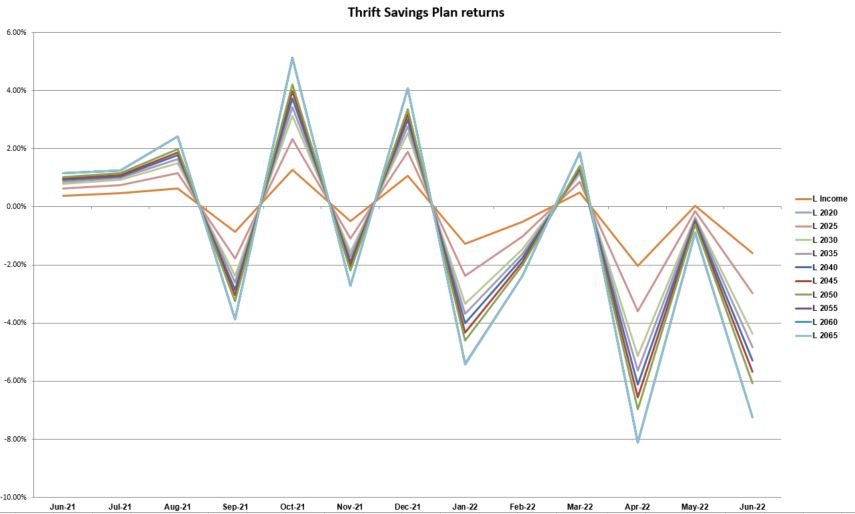

The lifecycle funds, which all saw declining monthly returns in June, are not faring much better. The L 2055, 2060, and the 2065 funds experienced the largest monthly decline, ending the month at-7.25 percent compared to-0.89 percent in May. The L Income fund saw the smallest decline, going from 0.04 percent in May to -1.60 percent last month.

Lifecycle funds haven’t turned a profit since April, with the exception of the L Income fund.

|

Thrift Savings Plan (June 2022 Returns)

|

|

Fund

|

June

|

Year-to-Date

|

Last 12 Months

|

|

G fund

|

0.29%

|

1.15%

|

1.89%

|

|

F fund

|

-1.94%

|

-10.08%

|

-10.05%

|

|

C fund

|

-6.55%

|

-19.96%

|

-10.62%

|

|

S fund

|

-7.95%

|

-27.92%

|

-29.80%

|

|

I funds

|

-8.21%

|

-18.95%

|

-17.11%

|

|

L Income

|

-1.60%

|

-4.84%

|

-2.87%

|

|

L 2025

|

-2.98%

|

-8.98%

|

-6.02%

|

|

L 2030

|

-4.37%

|

-12.88%

|

-9.29%

|

|

L 2035

|

-4.84%

|

-14.22%

|

-10.43%

|

|

L 2040

|

-5.29%

|

-15.49%

|

-11.50%

|

|

L 2045

|

-5.69%

|

-16.62%

|

-12.51%

|

|

L 2050

|

-6.07%

|

-17.66%

|

-13.40%

|

|

L 2055

|

-7.25%

|

-20.54%

|

-15.69%

|

|

L 2060

|

-7.25%

|

-20.55%

|

-15.69%

|

|

L 2065

|

-7.25%

|

-20.55%

|

-15.70%

|

Understanding TSP Funds

Core TSP Funds.

The five core funds included in the Thrift Savings Plan broadly cover the whole spectrum of publicly traded debt and equity instruments. The TSP participants are the only ones who can access the five funds managed by Blackrock Capital Advisers. None of them are sold publicly, but Blackrock does provide publicly traded versions of various TSP funds through its subsidiary, iShares, which provides a wide selection of ETFs.

One hundred percent of a wide market index’s worth of securities are held by four of the five funds, which are index funds. Participant contributions to the F and C Funds are placed in separate accounts, whereas contributions to the S and I Funds are placed in trust funds mixed with other tax-exempt pension and endowment funds.

All the funds, besides the G Fund, are fully invested in their individual indexes and do not consider the present or historical performance of either the particular index or the general economy. The share price of each TSP fund is determined daily and represents investment returns less trading and administrative expenses.

Government Securities Investment Fund (G Fund)

Only this core fund doesn’t invest in index markets and offers a principle return guarantee to investors. The G Fund invests in a unique non-marketable treasury instrument that the US government has created just for the TSP.

Thus, the fund comes with the lowest risk of the five funds, and unless the participant says otherwise, this fund automatically receives all contributions made to the TSP. It offers interest based on short-term, non-marketable Treasury securities with maturities ranging from a few days to 52 weeks.

Also, of all the basic funds, the G Fund has historically offered the lowest rate of return.

Contact Information:

Email: [email protected]

Phone: 6232511574

Bio:

I grew up in Dubuque, Iowa, where I learned the concepts of hard work and the value of a dollar. I spent years in Boy Scouts and achieved the honor of Eagle Scout. I graduated from Iowa State University and moved to Chicago and spent a few years managing restaurants. I then started working in financial services and insurance helping families prepare for the high cost of college for their children. After spending years in the insurance industry, I moved to Arizona and started working with Federal Employees offing education and options on their benefits. I became a Financial Advisor / Fiduciary to further help people properly plan for the future. I enjoy cooking and traveling in my free time.

Disclosure:

Investment advisory services are offered through BWM Advisory, LLC (BWM). BWM is registered as an Investment Advisor located in Scottsdale, Arizona, and only conducts business in states where it is properly licensed, notice filed, or is excluded from notice filing requirements. BWM does not accept or take responsibility for acting on time-sensitive instructions sent by email or other electronic means. Content shared or published through this medium is only intended for an audience in the States the Advisor is licensed in. If you are not the intended recipient, you are hereby notified that any dissemination, distribution, or copy of this transmission is strictly prohibited. If you receive this communication in error, please immediately notify the sender. The information included should not be considered investment advice. There are risks involved with investing which may include market fluctuation and possible loss of principal value. Carefully consider the risks and possible consequences involved prior to making an investment decision.